Forex Range Trading

2020/8/24

Contents:

For instance, you draw a trendline and put your sl, which is 1x atr, under that. The price might penetrate in the line but pull back and act as a shadow. It’s assumed it doesn’t go further one average candle and the shadow isn’t longer than an average candle. There is another side where the average daily range can be considered important particularly if you are a day trader or scalper. Let’s say I want to calculate the average daily range for one year which is something between 260 to 263 candles.

If you are ready to start https://forexaggregator.com/ trading, then the best thing you can do is download some free demo charts and test out your trading making sure to risk no real money until you are ready. If you don’t want to spend a lot of the time on the sidelines waiting for new trading opportunities, you need to be able to trade ranging markets. When making trades from the range high or low, normally your profit potential will be capped to a degree. This is because you are normally aiming for price to make a move back to the other side of the range. For example, if you take a long trade from the range support, you would be targeting the range resistance.

A Must-ReadeBook for Traders

The following sections discuss https://trading-market.org/ trading and range breakout tools and strategies. Range-bound trading is a strategy looking to identify and capitalise on forex pairs trading in price channels. Range-bound trading involves connecting highs and lows with trendlines to identify support and resistance areas. Mastering range trading strategies allows a trader to attempt to profit in times when the market shows no clear trend. Investments involve risks and are not suitable for all investors. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

If there is no trend , a range trading strategy might be executed. However, if the stock or other investment appears to trend in a particular direction, that would likely negate the value of a range trading strategy. It is the same as when you are trading trends – the aim is to buy low and sell high.

Pros & Cons Of Range Trading

The height of the MACD line indicates the level to which the price is overbought or oversold. It complements other strategies such as trend following and breakout trading but many use it successfully on its own. To sum up, the price’s getting to one of the range’s borders and the signal from an oscillator is the trigger for entering a trade. The probability of a successful trade will be higher if there’s a reversal candlestick pattern near the resistance/support. When an oscillator falls from a central line and reaches an extreme area on the downside, it means that the pair is oversold. If the pair is at the time near the support zone, it’s time to buy.

This chart shows with the red arrows where the traders should be trying to take short trades from the highs and long trades from the support at the lows. Conventional trading wisdom suggests that forex markets range 70-80% of the time. With that figure in mind, you must learn what range trading is and how to trade FX markets experiencing such conditions. You may often find that a range on one-time frame may not be relevant on another time frame. Therefore, I would always verify a range is relevant across as many time frames as possible, especially the higher chart time frames which I find can have more importance over the mid-long term.

Range trading the Forex market

Knowing this in advance will help you determine if you want to trade this pair, and will also assist with stop placement. Importantly, the range bar trading strategy helps by removing noise from charts, especially if a price is oscillating in a narrow range, which will be displayed as a single bar only. Turning points become clearer and support and resistance bands are emphasised. Range areas can be identified on a candlestick chart, though a range bar chart which is based on price movement rather than time allows the trader to view the volatility of a market too.

If you’re tired finding success with the traditional candlestick price chart you’ll find some value in doing some research and backtesting the range bar tool. If you’re looking for a more all-inclusive range trading strategy with an effective tool to time your entries and exit points you’re way better off using the Bar Range indicator MT4. Now that you’re familiar with how to calculate range bars and the advantages behind MT4 Range Bar indicator, let’s develop a range trading strategy. Breakouts happen when prices advance strongly outside the defined support and resistance levels and consequently when resuming an old trend or establishing a new one. It is, therefore, important to determine the ideal places to put in place stop losses that will help limit your losses in case a price breakout occurs. Range trading strategies help investors exploit lucrative opportunities when there is sideways price action in the market.

There are also clear stop loss and take profit placement guidelines. There are also envelope-type volatility indicators such as Bollinger Bands and Keltner Channel computed to ‘contain’ price. Such indicators will have the price contained within their upper and lower bands, serving as references for support and resistance levels. In ideal range setups, the volume should decrease when the price is about to hit the support or resistance levels and increase after bouncing from those levels. Volume indicators help assess whether a price movement in the market is backed by conviction. Perhaps surprisingly, the best results seem to have been achieved by filtering out moves of less than 0.5%, which is approximately an average daily move for a major currency pair.

Traders might enter breakout’s direction or the breakdown from a trading range. You could enter a long position when the price is trading at support, and the RSI gives an oversold reading below 30. Or you could decide to go short if the RSI reading reaches the overbought territory above 70. If price breaks out from either the upper trendline resistance or lower trendline support, it marks an end to the range-bound trading. Traders will use the ATR to figure out if the current price is ready to break out from its current range. Classed as an oscillator, the ATR is simple to monitor on your charts because it’s a single line.

The USDCHF bounces back. Remains in the range. – ForexLive

The USDCHF bounces back. Remains in the range..

Posted: Wed, 01 Mar 2023 17:02:00 GMT [source]

Set the stop https://forexarena.net/ well clear of the range boundary to allow for failed breaks. The ATR signal is useful in deciding a stop loss, as are support and resistance zones . The basic way to trade ranges is to enter near to the range boundaries. That means selling when the price is at the top of the range and buying when it is at the bottom. The top of the range provides a resistance area to price rises and the bottom a support area for price falls.

Price bounces can be triggered by contact with any kind of support and resistance area. This ebook is a must read for anyone using a grid trading strategy or who’s planning to do so. Grid trading is a powerful trading methodology but it’s full of traps for the unwary. This new edition includes brand new exclusive material and case studies with real examples. Go to the Withdrawal page on the website or the Finances section of the FBS Personal Area and access Withdrawal. You can get the earned money via the same payment system that you used for depositing.

Investors usually employ a system where they hold long and short positions at different times, unlike long term investors who hold a position reflecting the overall direction of the trend. Market prices often move horizontally, meaning there can be limited opportunities to enter a market. In fact, it is estimated that financial markets only trend about 30% of the time.

Remember that ranges are difficult to trade, and traders will eschew ranges to trade in trending or breakout situations. Trends can be grabbed onto, and breakouts offer a wonderful chance to break even in the markets, but ranges are another kettle of fish altogether. To catch the range, prices have to get caught between support and resistance. When this occurs, traders can address the range in 1 of 2 ways and trade for the range to continue, which means the upside is limited or looking for the breakout from the range in the face of a new trend. Volatility is the frequency and severity of price changes in the market. Generally, ranging markets are characterized by low volatility, with prices making predictable movements off support and resistance levels.

The Traders Union names the Top 10 Forex Brokers in the World – Benzinga

The Traders Union names the Top 10 Forex Brokers in the World.

Posted: Thu, 02 Mar 2023 17:55:59 GMT [source]

If we generally talk about the term range, it means the limits between which things can increase or decrease. The term quite matches range trading, where we analyse the price movements for a particular time period. The Range is a prerequisite to analyse the investments and know when to buy and sell. An example of this happening on a chart is below; price was trading sideways for a sustained period of time, but during this period it was also trying to breakout through the resistance level. The chart below shows an example of where traders would be trying to hunt their trades in a ranging sideways trading market.

Spiking price action is also common which is why it’s recommended to lock in profits quickly once the target or an important technical level has been reached. If a trader is looking to trade a breakout, then other indicators can be used to help identify whether the breakout will continue. A significant increase in volume on a breakout, either higher or lower, would tend to suggest that the change in price action will continue.

- Range trading can offer some of the simplest and easiest trading opportunities.

- Instead of looking for just the right entry, range traders prefer to be wrong at the outset so that they can build a trading position.

- Then, by studying it regularly, traders can be pro at range trading.

- Stay informed with real-time market insights, actionable trade ideas and professional guidance.

For example, say oil is trading at $65 and you believe it is going to rise to $70, then you might trade in a range between $65 and $70 over the next few weeks. You could try and range trade it by buying oil at $65, then selling it if it goes higher to $70. You would repeat this process until you think oil will no longer trade in this range. ADA buyers can buy at current levels or wait for a breakout above the 100 SMA and current consolidation before aiming for inflection points like the .3800 mid-range area.

Besides the indicator position, I don’t see much enticing with this trade especially since price action did not show any sign of a potential reversal. Finally, at “D” price pushes to the new extreme, shows weakness while the indicator is overbought and you see a momentum line cross. A popular style of trading any market is taking trades when markets are in a trading range. Potential support and resistance levels are more clearly visible on the chart. For example, if you have a 100 pips range selected, each of these range bars is going to be equivalent to that range. A trading range takes place when a financial instrument oscillates between two upwards and downwards boundaries for a period of time.

夏季休業について

2020/8/10

平素よりご愛顧頂き誠にありがとうございます

下記期間を夏季休業期間と致します

2020年8月13日(木)〜8月16日(日)

上記休業期間中に頂いたご連絡につきましては、17日以降順次対応させて頂きます

何卒宜しくお願い致します

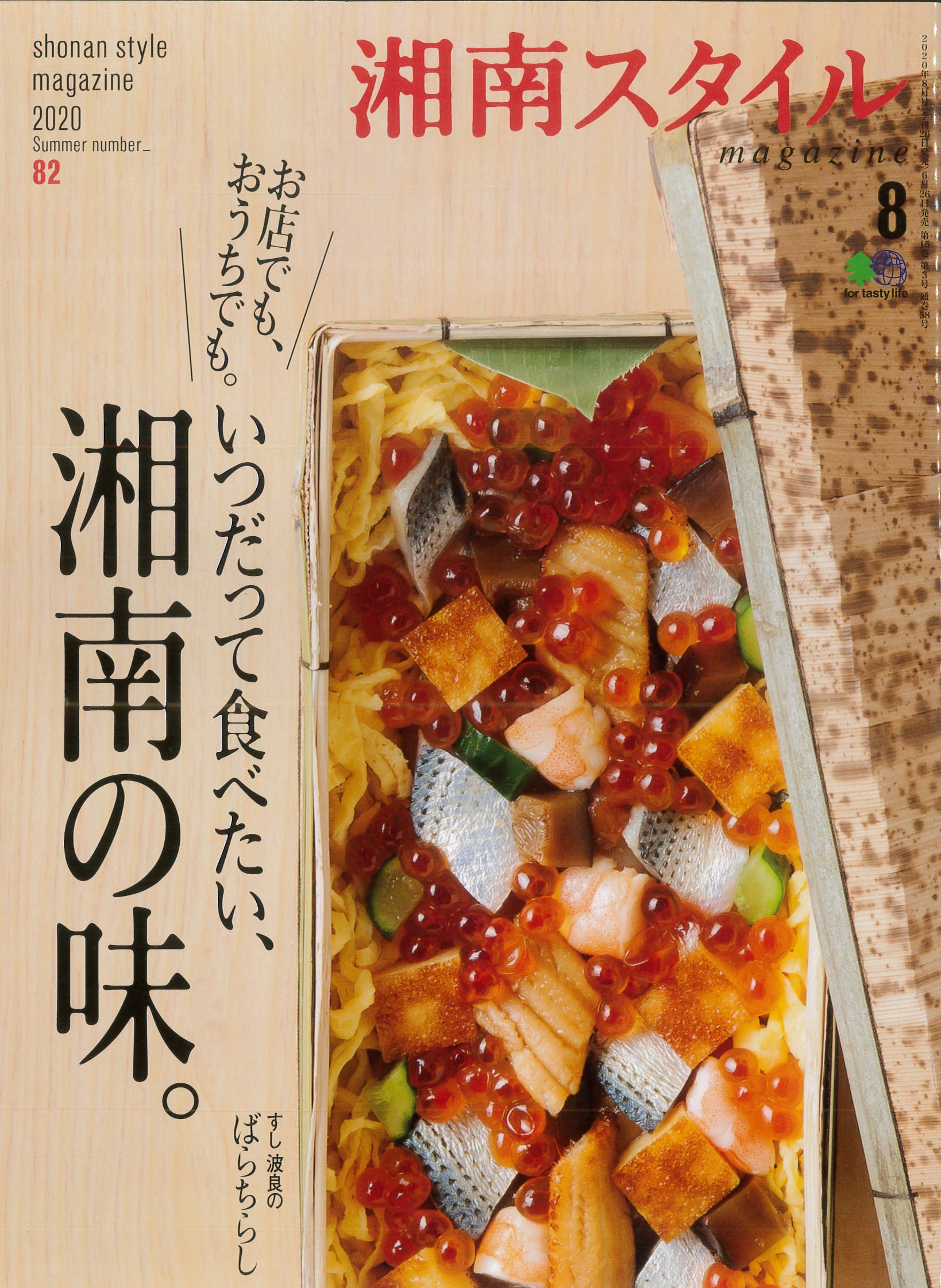

湘南スタイル NO.82 2020年8月号 に掲載されました

2020/8/1

湘南スタイル8月号に、楽居の工房 頑居堂と大工が紹介されました。